Description

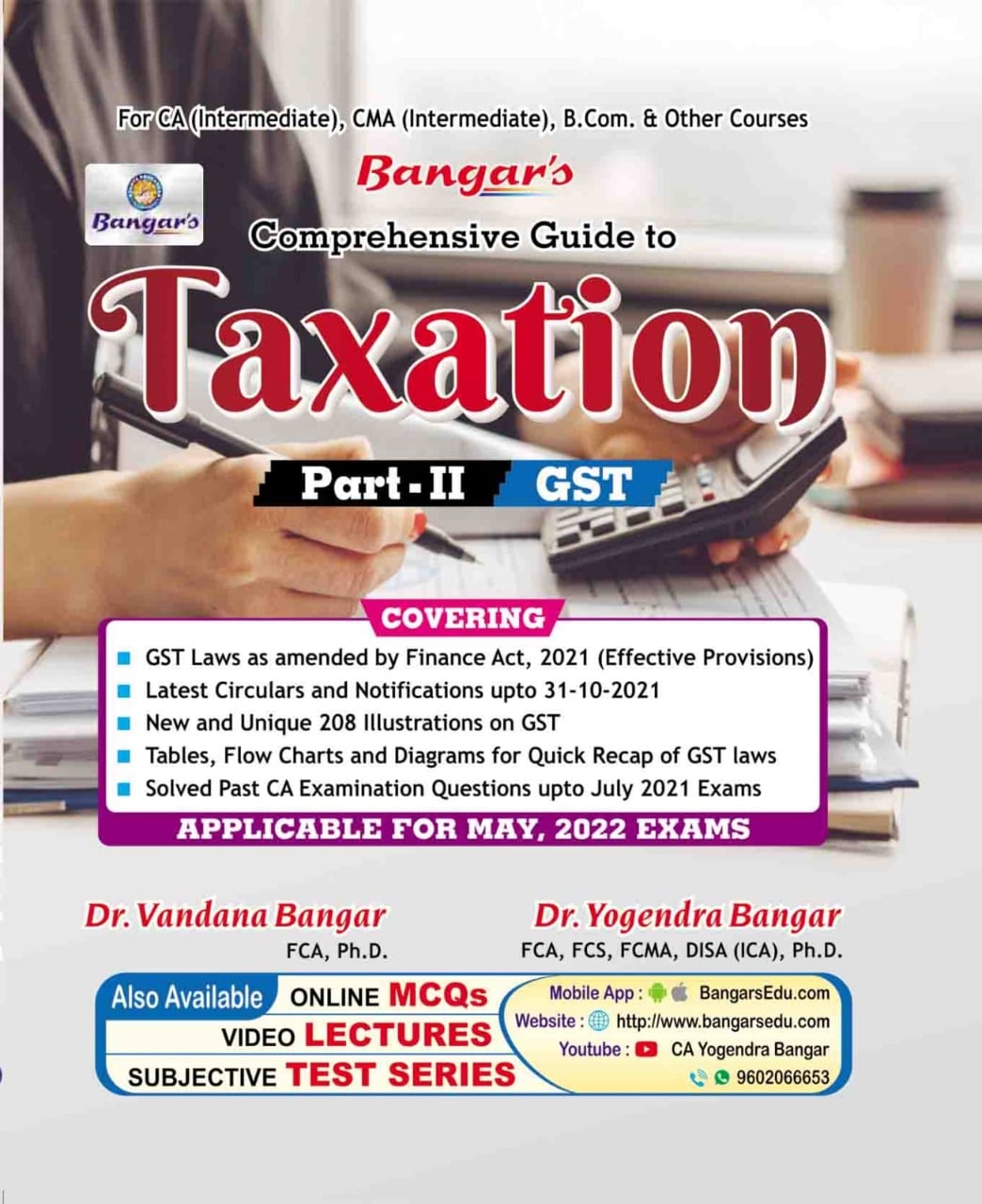

This book covers the syllabus prescribed for CA Intermediate Course (New Scheme) as well as CA Intermediate (IPCC) (Old Scheme).

The book incorporates the following :

- Analysis of provisions of CGST Act, 2017, IGST Act, 2017 and relevant Rules;

- GST Laws as amended by Finance Act, 2021 (Effective Provisions);

- New and Unique 208 Illustrations arranged topic-wise/section-wise;

- Tables, Flowcharts and Diagrams for easy understanding and Quick Recap of GST Laws;

- All the latest developments in the GST Laws, including latest Circulars and Notifications upto October 31st, 2021

SUBJECT INDEX

- GST in India – A Brief Introduction

- Supply under GST

- Charge of GST

- Composition Levy

- Exemptions from GST

- Time of Supply

- Value of Supply

- Input Tax Credit

- Registration

- Tax Invoice, Credit and Debit Notes

- Payment of Tax

- Returns

Details :

- Publisher : Aadhya Prakashan

- Author : Dr. Yogendra Bangar & Dr. Vandana Bangar

- Edition : 19th Edition December 2021

- ISBN-13 : 9788190502986

- ISBN-10 : 9788190502986

- Binding : Paperback

- Language : English

Reviews

There are no reviews yet.