Description

This book is a commentary on the proposed provisions of the Finance Bill 2023. It covers the following:

- Clause-by-clause detailed analysis

- Covering all the amendments proposed by the Finance Bill 2023.

All complex provisions have been explained with illustrations which helps the readers to comprehend the new provisions in a simplified manner.

The Present Publication is the 2023 Edition, authored by Taxmann’s Editorial Team, with the following coverage:

- Table of ‘List of Amendments’

- [Tax Rates] applicable for the assessment year 2024-25

- [Threadbare Analysis] on all proposed amendments

- [Examples/Illustrations] to understand all complex provisions

- [Charts & Tables] to get an overview of the provisions

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries and Lawyers. This team works under the guidance and supervision of Editor-In-Chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorised and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Analytical write-ups should be provided on recent, controversial, and important issues to help the readers to understand the concept and its implications

- It must be ensured that every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements must be supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied.

Details

- Paperback :

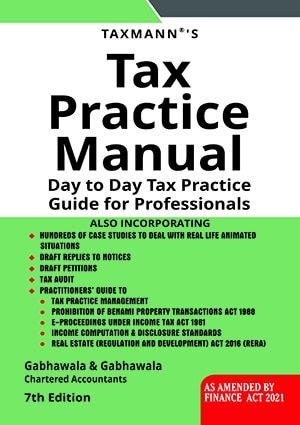

- Publisher : Taxmann

- Author : Taxmann

- Edition : February 2023

- Language : English

- ISBN-10 : 9789356226678

- ISBN-13 : 9789356226678