Description

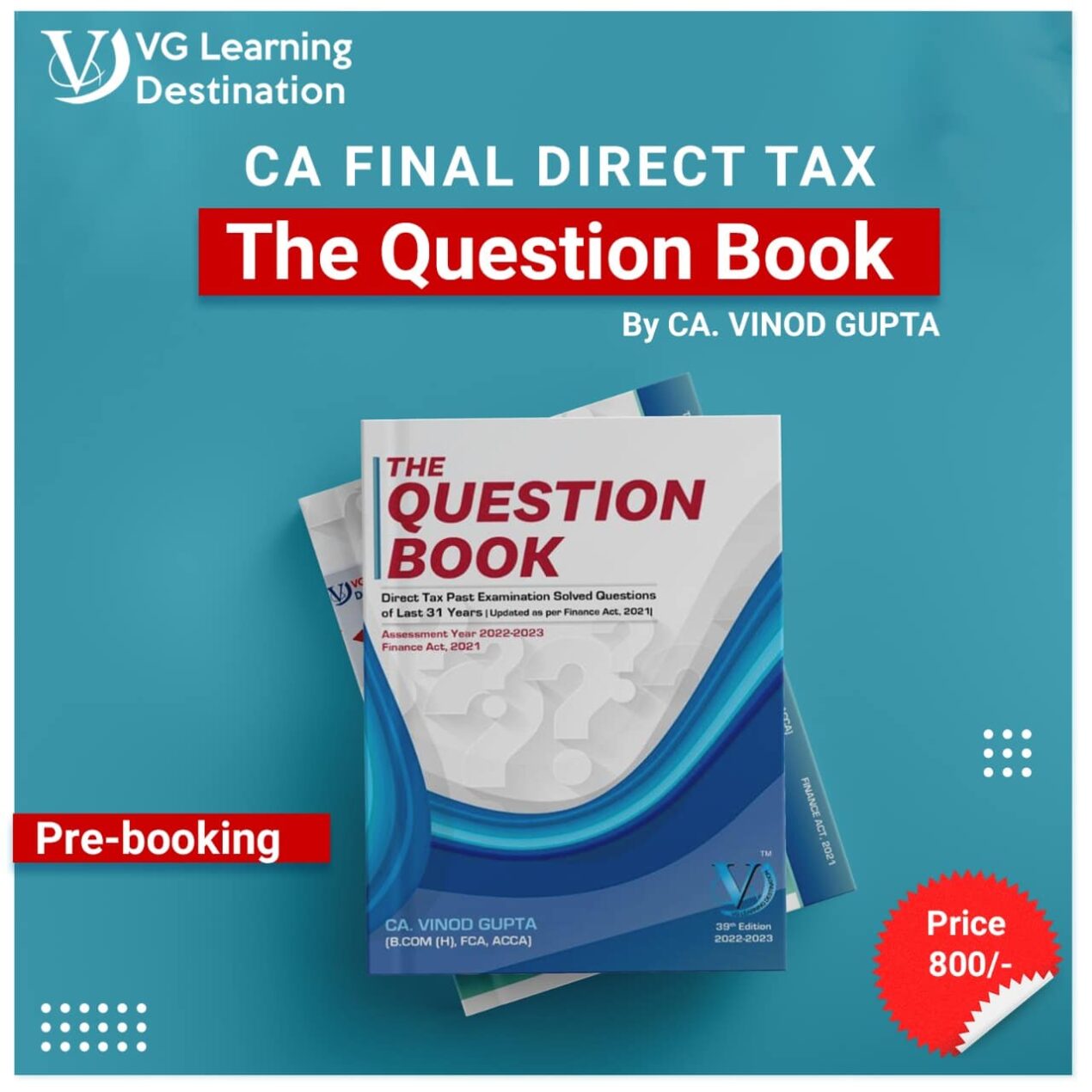

This compilation of questions of last 27 years of CA Final Exams is to let you understand the pattern of questions asked f1’om various parts of the syllabus. So, you can solve questions of last 56 attempts. This Question Book will help you in practicing the past exams questions This Question Book is updated according to the present law of Income Tax as amended By Finance Act, 2021. Questions have been modified according to the present law, to help you understand in the current context this question book can be best used along with our Summary Module. When you are preparing for the exams and during the last moment, i.e., when you are at the revision stage, you can refer the question book to understand the types of questions asked and their frequency earlier, we used to analyses the weight age of the chapter based on the number of questions asked from the respective chapters. But now the scope of our own analysis is trimmed Down to certain extent, since the ICAI itself shared the weight age of the sections. The demarcation of the sections is made clear along with their weight age and this will be the Broader insight about the various topics.

Contents

- Capital Gains

- Income from Other Sources

- Taxation of income from Dividend and Deemed Dividend

- Employee Stock Options (ESOPs)

- Clubbing of Income

- Profits and Gains of Business or Profession

- Deduction and collection of tax at source

- Taxation of AOPs &BOIs

- Taxation of Firms

- Taxation of Limited .Liability Partnership (LLP)

- Amalgamation and Its Tax Implications

- Demerger and Its Tax Implications

- Tonnage Taxation

- Taxation of Agricultural Income

- Taxation of Hindu Undivided Family

- Taxation of Political Parties

- Taxation of Electoral Trust

- Taxation of Co-operative Societies

- Liquidation of Companies

- Set off or carry forward and set off Losses

- Dividend Stripping

- Bonus Stripping

- Taxation of Business Trust & Its Unit Holders

- Taxation of Charitable / Religious Trusts

- Principle of Mutuality/Mutual concerns

- Alternate Minimum Tax (AMT) on All Assessces Except Companies (Chapter XII-BA)

- Minimum Alternate Tax

- Deductions under Chapter VI-A Part C

- Deduction Under Section 10AA

- Other Deductions Under Chapter VI-A

- Filing of Return of Income

- Assessment Procedures

- Dispute Resolution panel (DRP)

- Assessment of Income Escaping Assessment

- Time limits for completion of Assessment or Reassessment

- Miscellaneous Provisions

- Power to Call for Information and Conduct Survey

- Search & Seizures

- Special procedure of Assessment or Reassessment in case of search & seizure

- Mandatory & Penal Interest under section 234A, 234B & 234C

- Appeals & Revision

- Certain Concepts Related to Assessments, Appeals, etc

- Assessee in Default

- Statement of Financial Transaction or Reportable Account (SFTRA)

- Penalties & Prosecutions

- Settlement Commission

- Residential Status

- Taxability of Royalty, Fee for Technical Services and Interest

- Special Provisions for Taxation of Non-Residents & Foreign Companies

- Double Taxation Avoidance Agreements (DTAA)

- Advance Rulings (Section 24SN -24SV)

- Transfer Pricing

- Limitation on Interest Paid to Associated Enterprises

- Notified Jurisdictional Area (NJA)

- Equalisation Levy

- TDS on Payment made to Non Residents

- Overview of Model Tax Convention

- Amendments on Income Computation and Disclosure Standards (ICDS)

Details :

- Publisher : VG Learning Destination

- Author : Vinod Gupta

- Edition : 39th Edition 2022-2023

- ISBN-13 :

- ISBN-10 :

- Pages : 706 pages

- Language : English

- Binding : Paperback

Reviews

There are no reviews yet.