Description

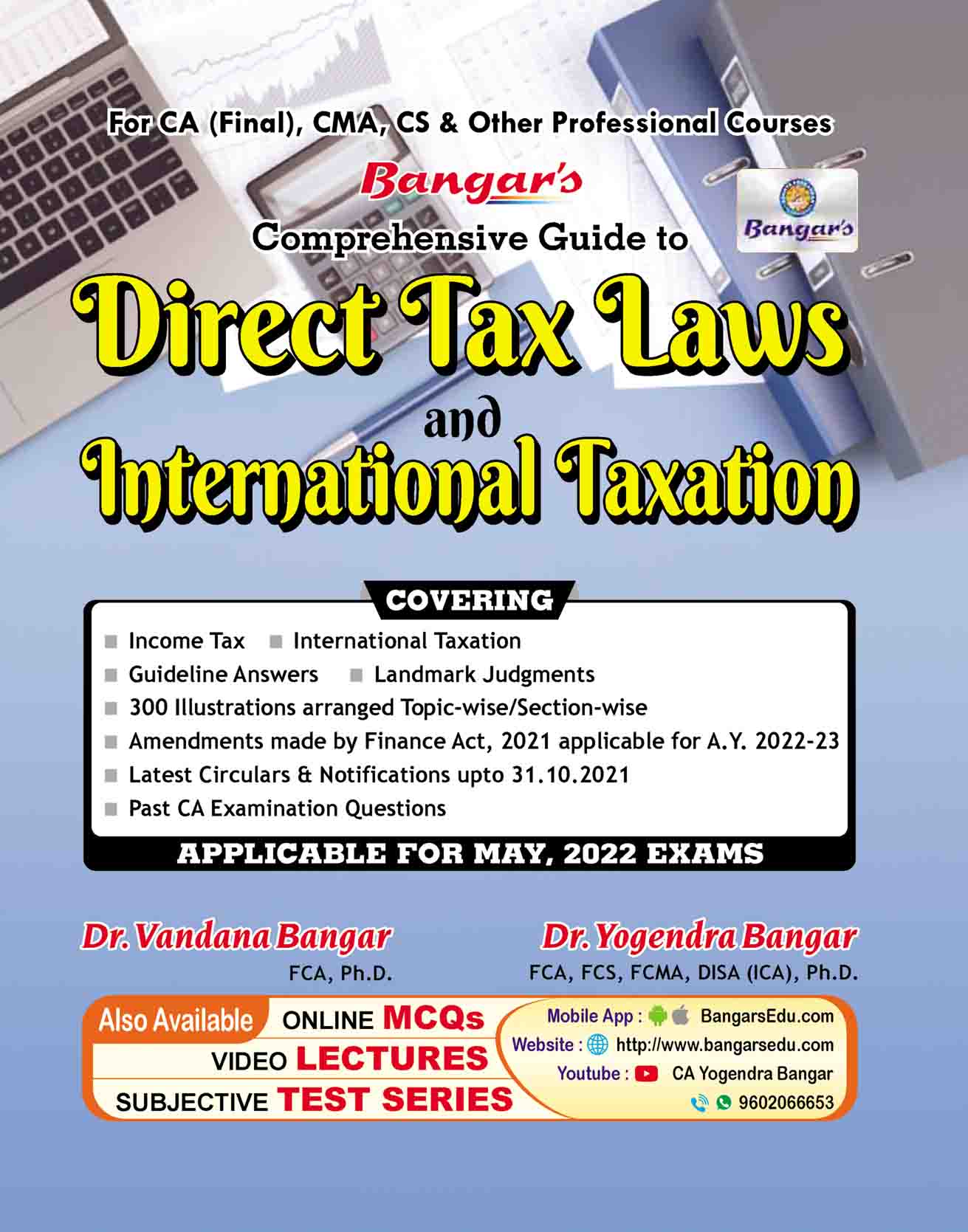

It is with great pride and pleasure that we bring to you our book – “Comprehensive Guide to Direct Tax Laws and International Taxation” that has not only enjoyed great market success but has also received the appreciation of our dear readers. This book covers the syllabus prescribed for CA Final New Scheme and Old Scheme.

Keeping into mind the feedback of the readers of the book, we have made necessary changes in the contents, outlook and overview of the book with a view to make it more precise and student-friendly.

- Amendments made by Finance Act, 2021 applicable for A.Y. 2022-23.

- All the latest developments in Income Tax Law including Circulars and Notifications upto October 31st, 2021.

- 300 Illustrations arranged Topic-wise/Section-wise & appended with head notes for easy understanding.

- Coverage of Past CA/CS Examination Questions

SUBJECT INDEX

Part I : Direct Tax Laws

- Basic Concepts

- Residential Status

- Salaries

- Income from House Property

- Profits and Gains of Business or Profession

- Capital Gains

- Income from Other Sources

- Income of Other Persons Included in Assessee’s Total Income

- Aggregation of Income and Set-off or Carry Forward of Loss

- Deductions from Gross Total Income

- Assessment of Various Entities (Individuals, HUF, Firms/ LLP, AOP/ BOI, Co-operative Societies, Securitisation Trusts, Business Trusts & AIF)

- Incomes Exempt from Tax

- Assessment of Trusts

- Assessment of Companies

- Tonnage Tax Scheme

- Income Tax Authorities

- Procedure for Assessment

- Liability in Special Cases

- Tax Deduction and Tax Collection at Source

- Advance Tax, Recovery, Interest and Refunds

- Dispute Resolution

- Appeals and Revision

- Miscellaneous Provisions and Penalties & Prosecution

- Tax Planning, Tax Evasion and Tax Avoidance

PART II : INTERNATIONAL TAXATION

- Non-Resident Taxation

- Double Taxation Relief

- Transfer Pricing and Other Anti-Avoidance Measures

- Advance Rulings

- Equalisation Levy

- Overview of Model Tax Conventions

- Application and Interpretation of Tax Treaties

- Fundamentals of Base Erosion and Profit Shifting (BEPS)

- General Anti-Avoidance Rules (GAAR)

About The Author

Mr. Bangar a member of ICAI, is the founder and pioneer of AADHYAS Academy and Prakashan. A thorough educationist and a self made man with an excellent academic record throughout, he laid the foundation stone of Aadhya Academy in 1996. Beginning with table coaching to a couple of students, he has over the years, step by step with great determination and hardwork built a strong Knowledge based education support system providing a platform to aspiring students to pursue and achieve their goals. He believes in the saying, Learn as if you were to live forever,

it is his continuous thirst for knowledge that has gained him a name amongst intellectual heads in the renowned Institutes of Commerce. His commitment for quality education has enabled him to develop a unique method of teaching and learning which retains the strong characteristics of conservative learning and teaching methods developed in lines with the latest technologies. Thus, blending the values of traditional system with the modern concept of education with technology.

His education is B,Com. (Hons.), FCA, CS, FICWA, DISA (ICA) Gold Medalist in B.Com (Hons.) Raj. University,Presidents Award holder of the ICSI Rank holder in Chartered Accountancy Examination, Rank holder in Chartered Accountancy Examination, Faculty Member ICA & ICWA Institute in Jaipur, Presently conducting Classes for Professional Courses, Author of various books at UG, PG & professional levels, Contributing articles to leading magazines and newspapers. He is Gold Medalist in B.Com. (Hons.) Raj. University.

His research are:-

- All India Rankholder in CS Inter (1st) and CS Final (2nd) Exams

- Rankholder in CA Exams

- A well renowned faculty teaching Direct and Indirect Taxation

- Author of various books at UG, PG and professional levels

- Faculty Member CA, CS and CWA Institute at various branches

- Presented papers and delivered lectures in various seminars

- Contributed articles to leading magazines like The Chartered Accountant, Taxman, Excise Law Times, Service Tax Review, etc. and various newspapers

- Presently engaged in CA Practice

Vandana Bangar Vandana Bangar is one of the renowned writer in the field of finance, especially in the area of DT,Taxation,Tax Laws and Practice for CA Final,CA IPCC,CS Executive exams. The author has written a number of excellent books in the area of DT,Taxation,Tax Laws and Practice that is useful for CA Final,CA IPCC,CS Executive exams.B.Com, FCA Gold Medalist in B.Com Karnataka University, Author of various books at UG, PG & professional levels, Faculty in Business & Corporate Laws, A prolific author and contemporary writer of articles in leading magazines and newspapers.

Reviews

There are no reviews yet.