Description

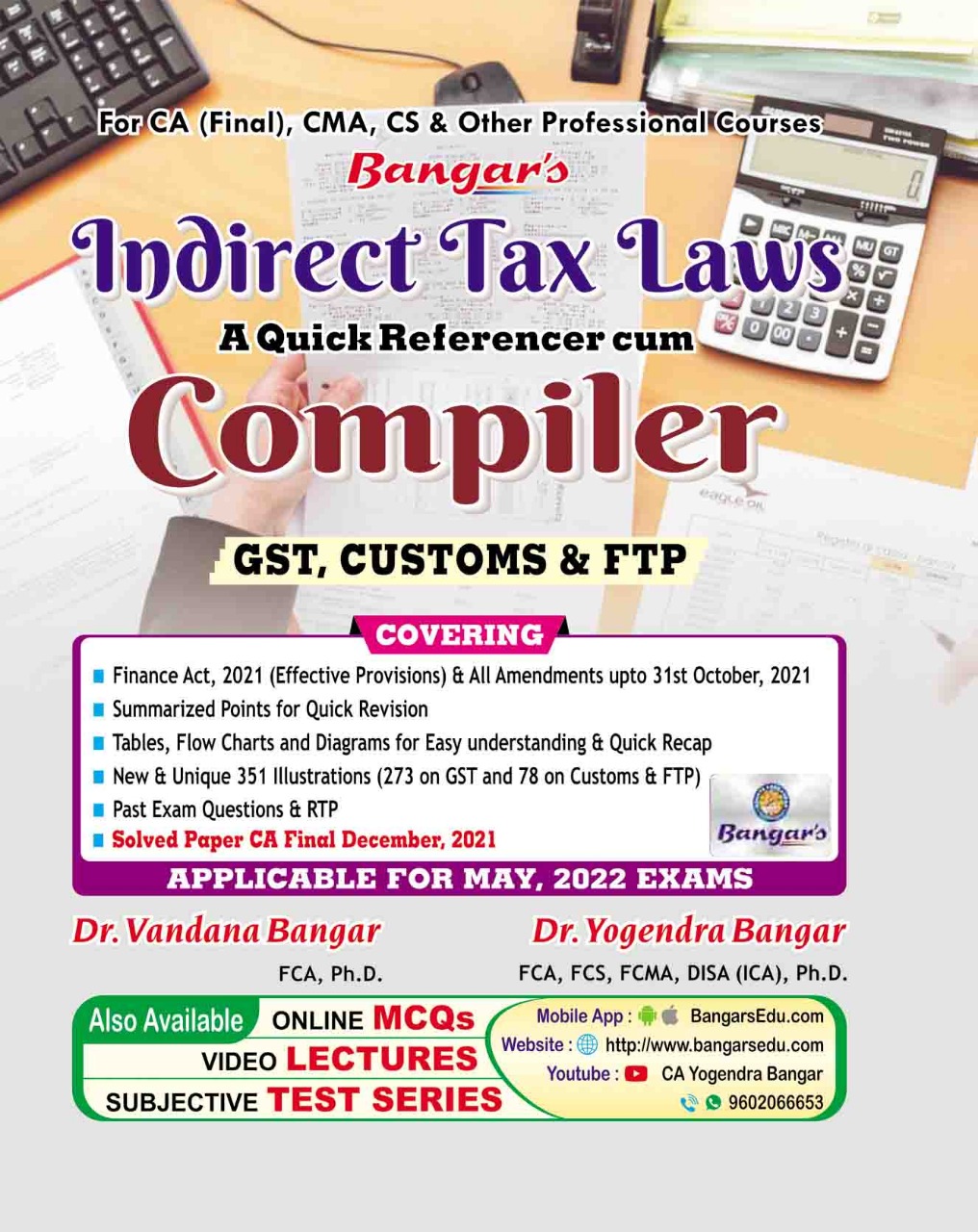

This book incorporates the following

- Finance Act, 2021 (Effective Provisions) & all Amendments up to 31st October, 2021

- Summarized Points for Quick Revision

- Tables, Flow Charts and Diagrams for Easy understanding & Quick Recap

- New & Unique 351 Illustrations (273 on GST and 78 on Customs & FTP)

- Past Exam Questions, ICAI Practice Questions & RTP

- Solved Paper CA Final December, 2021

.SUBJECT INDEX

SECTION A : GOODS AND SERVICES TAX (GST)

1.GST in India A Brief Introduction

2.Supply under GST

3.Charge of GST

4.Composition Levy

5.Exemption from GST

6.Place of Supply, Export and Import

7.Time of Supply

8.Value of Supply

9.Input Tax Credit

10.Registration

11.Tax Invoice, Credit and Debit Notes & E-way Bill

12.Accounts and Records

13.Payment of Tax, TDS & TCS

14.Returns

15.Refunds

16.Administration, Assessment and Audit

17.Inspection, Search, Seizure and Arrest

18.Demands, Recovery & Liability to Pay in Certain Cases

19.Advance Ruling, Appeals and Revision

20.Offences and Penalties

21.Job-Work and Miscellaneous Provisions

SECTION B : CUSTOMS

22.Basic Concepts

23.Classification & Types of Customs Duties

24.Valuation

25.Importation and Exportation

26.Duty Drawback

27.Baggage, Postal Articles & Stores & Search

28.Exemptions and Refunds

SECTION C : FOREIGN TRADE POLICY

About the Author:-

Dr. Yogendra Bangar

Mr. Bangar a member of ICAI, is the founder and pioneer of AADHYAS Academy and Prakashan. A thorough educationist and a self made man with an excellent academic record throughout, he laid the foundation stone of Aadhya Academy in 1996. Beginning with table coaching to a couple of students, he has over the years, step by step with great determination and hardwork built a strong Knowledge based education support system providing a platform to aspiring students to pursue and achieve their goals. He believes in the saying, Learn as if you were to live forever, it is his continuous thirst for knowledge that has gained him a name amongst intellectual heads in the renowned Institutes of Commerce. His commitment for quality education has enabled him to develop a unique method of teaching and learning which retains the strong characteristics of conservative learning and teaching methods developed in lines with the latest technologies. Thus, blending the values of traditional system with the modern concept of education with technology

Dr. Vandana Bangar

Mrs. Bangar a member of ICAI, is a person with a bright and successful educational background. She joined her husband Shri Yogendra Bangar in this association as a faculty in Business and Corporate Laws. She believes that the strongest people arent always the people who win, but the people who dont give up when they lose. She has been a strong support in building the Academy. Being committed towards achieving the vision set for Aadhyas, she has left no stone unturned in taking the institution to its present heights.

| bookauthor | Vandana Bangar, Yogendra Bangar |

|---|---|

| binding | Paper back |

| edition | 19th Edition 2022 |

| hsn | 49011010 |

| language | English |

| publisher | Aadhya Prakashan |

| isbn | 9788190502955 |

Reviews

There are no reviews yet.