Description

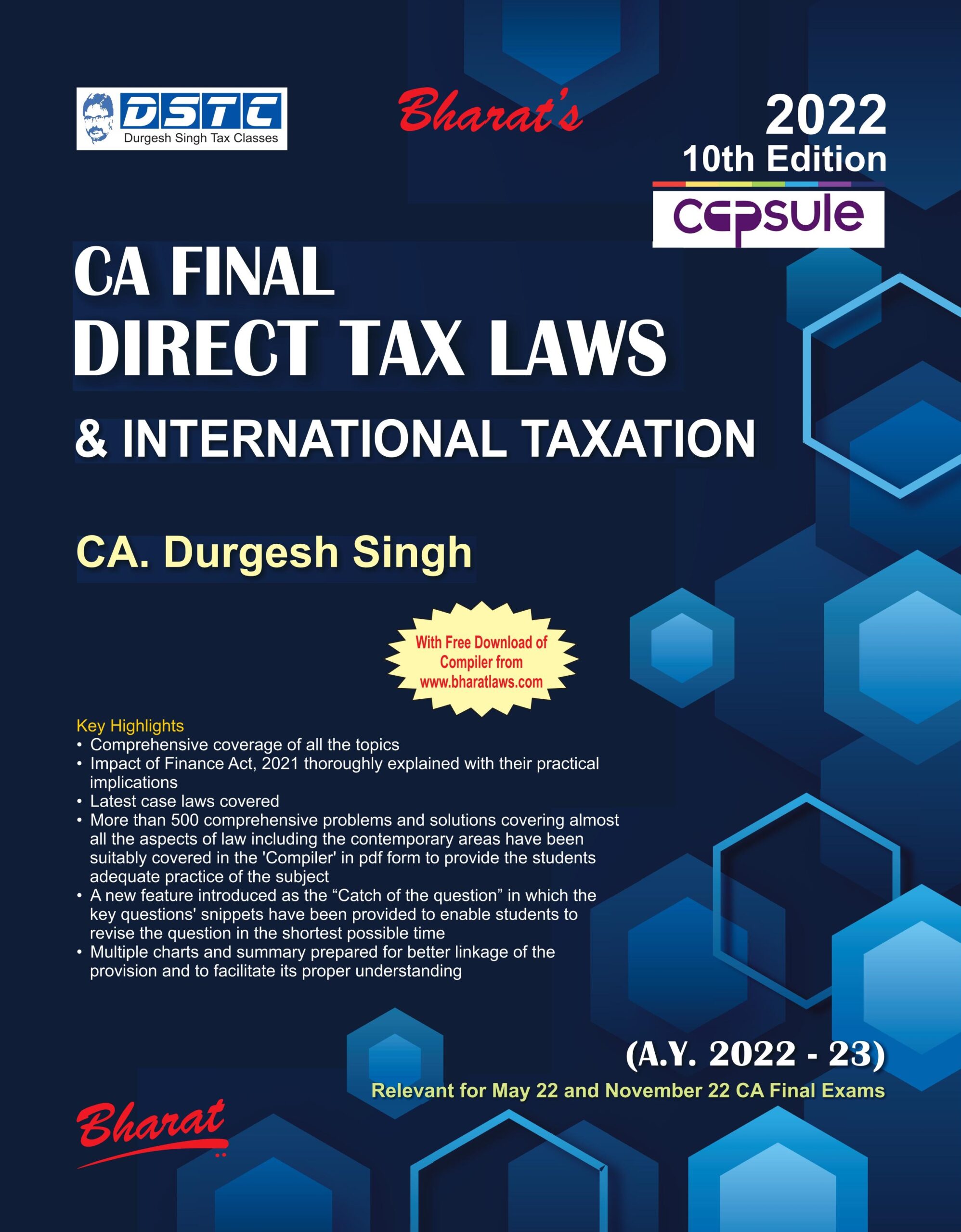

This book is the need of the hour where

- The provision has been logically explained and summarised to provide the reader the understanding about various facets of the provisions in crisp and precise manner.

- The provision is followed up with large number of problems, many of which have been customised to equip the reader with the various combinations with which a particular provision could be targeted in the exams.

- Contemporary areas like ICDS, Transfer Pricing, Non-resident & International Taxation, Ind AS Impact on MAT have been duly supported with thought provoking self designed questions and answers to expose the students to its real life application. In recent past, ICAI has endeavoured to break the norms by setting up the students on the evolving areas in taxation for which students have no support either in any classroom coaching or in any reference materials.

- Decisions reported by the ICAI till date have been suitably digested in the case-law segment in the manner and presentation required by the ICAI.

- New incorporation of additional topics on International Taxation making it relevant even for new course students.

- Appendix has been attached towards plethora of provisions relating to cash transactions, Real estate industry at one place so as to enable the student to revise these aspects at one place.

- This colourful edition shall enable the reader a soothing experience. Further, all amendments of Finance Act, 2021 and the recent notifications have been highlighted in red print so as to enable the reader to discern the amendment portion clearly.

Contents

| Volume 1 – Part A | ||

| 1 | Income Tax Rates (For A.Y. 2021-22) | |

| 2 | Income from Salary | |

| 3 | Income from House Property | |

| 4 | Profits and Gains from Business or Profession | |

| 5 | Business Deductions Under Chapter VIA and 10AA | |

| 6 | Income Computation and Disclosure Standards (ICDS) | |

| 7 | Alternate Minimum Tax (AMT) | |

| 8 | Assessment of Partnership Firm | |

| 9 | Chapter VIA Deductions | |

| 10 | Capital Gains | |

| 11 | Income from Other Sources | |

| 12 | Set Off and Carry Forward of Losses | |

| 13 | Clubbing Provisions | |

| 14 | Additional Q & A | |

| Part B | ||

| 15 | Assessment Procedure | |

| 16 | Rectification, Appeal & Revision | |

| 17 | Recovery Proceedings | |

| 18 | Settlement Commission & AAR | |

| 19 | Penalties & Prosecution | |

| 20 | Refund Provisions | |

| 21 | Case Laws | |

| Volume 2 – Part C | ||

| 1 | Special Tax Rates of Companies | |

| 2 | Alternative Tax Regime | |

| 3 | Co-Operative Society & Producer Companies | |

| 4 | Taxation of Dividend | |

| 5 | Surrogate Taxation | |

| 6 | Trust Taxation | |

| 7 | Hindu Undivided Family | |

| 8 | Assessment of Association of Person (AOP) & Body of Individual (BOI) | |

| 9 | Liabilities in Special Cases | |

| Part – D | ||

| 10 | Tax Deducted at Source (TDS) | |

| 11 | Tax Collected at Source (TCS) | |

| 12 | Advance Tax and Interest | |

| Part E | ||

| 13 | Non Resident Taxation | |

| 14 | Taxation of NR Sportsman | |

| 15 | Double Taxation Relief | |

| 16 | Miscellaneous Provision | |

| 17 | Equalisation Levy | |

| 18 | Transfer Pricing | |

| 19 | Concepts & Principles of Interpretation of Double Taxation Avoidance Agreements (DTAAs)/Tax Treaties (Only for New Syllabus) | |

| 20 | Miscellaneous Part of International Taxation (Only for New Syllabus) | |

| 21 | General Anti Avoidance Rules (GAAR) | |

| 22 | Additional Practical Problems | |

| 23 | Case Laws | |

| 24 | Appendices | |

| 25 | Multiple Choice Questions | |

About the Author

CA. Durgesh Singh has overall 14 years teaching experience at CA Final in Direct & Indirect Taxes. He is immensely popular with students for his teaching ski lls on the subject. With a big four background, he is currently a Partner in a large CA Firm with an expertise in Corporate, International and Indirect Taxation matters. He believes in the mantra that “if you know why, you know how”. He is known for conceptual teaching along with problem solving in class for better presentation of answers in exams. At the same time he summarises the entire subject through charts for last day revision and preparing for the exam day through mock tests. His students have been All India Rank holders and best paper awardees in Direct and Indirect Taxes. His students are preferred in Big Four as his teaching is more contemporary, suited to the present dynamic scenario. He is the only faculty in India of repute to teach Direct as well as Indirect Taxation at CA Final & I PCC level

| bookauthor | Durgesh Singh |

|---|---|

| binding | Paper back |

| edition | 10th Edition 2022 |

| hsn | 49011010 |

| isbn | 9789386921116 |

| language | English |

| publisher | Bharat Law House |

Reviews

There are no reviews yet.