Description

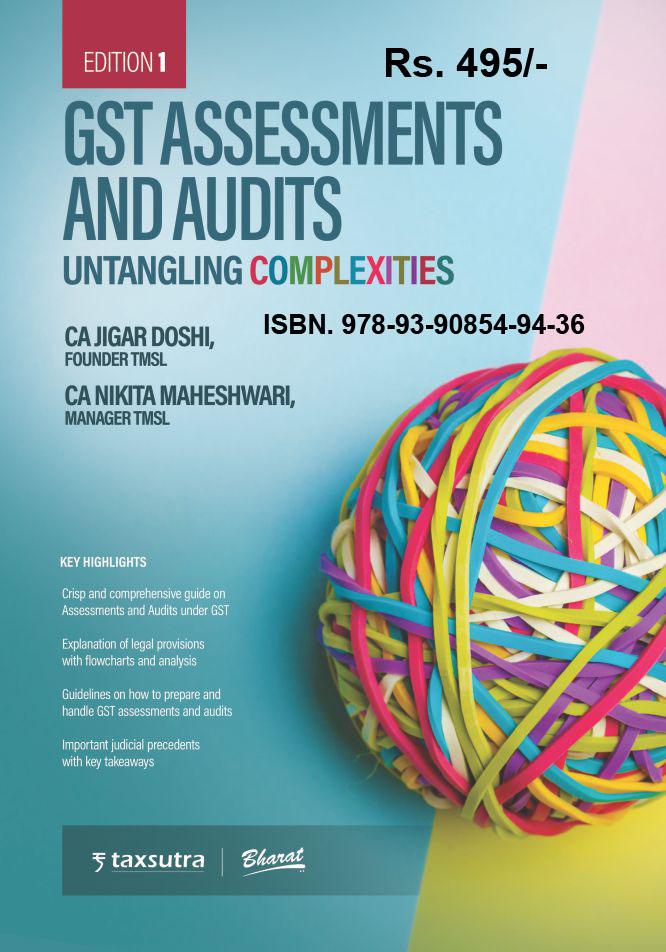

Taxsutra is considered the most credible source of tax news in the tax fraternity. What started as a fledgling start-up has now become a leading brand in the tax world not only in India, but across the globe. Taxsutra’s diverse customer set includes Fortune 500 Companies, large Indian Business Groups, Global Conglomerates, Tax Judges, IRS Officers, CBDT, Tax Lawyers & thousands of tax practitioners.

About the Author

should accustom itself to such changes. Having conducted and being on the panel of a Government training platform, it further helps in stepping into the Government’s shoes.Also practicing under other international VAT practices, is a trainer at various forums undertaking seminars for GCC VAT. Further, a holder of

the ‘Young Accountant of the Year’ hosted by the International Accounting Bulletin (IAB) held in United Kingdom in the year 2019 has created a presence in the international market.

Nikita Maheshwari :The co-author CA Nikita Maheshwariis an indirect tax professional with an extensive experience in Service tax and GST. She has led and executed GST transition for various MNCs in India. She is also an avid reader and technical content writer. Various interactions with tax authorities coupled with a consulting experience of over 8 years have not only provided her with substantial exposure in understanding the Government’s approach towards assessments and audits but also given her an inside-out view of the industry. This book is her endeavour to bring these perspectives together.

| bookauthor | Jigar Doshi, Nikita Maheshwari |

|---|---|

| binding | Paper back |

| edition | 2022 |

| hsn | 49011010 |

| isbn | 9789390854943 |

| language | English |

| publisher | Bharat Law House |

Reviews

There are no reviews yet.