Description

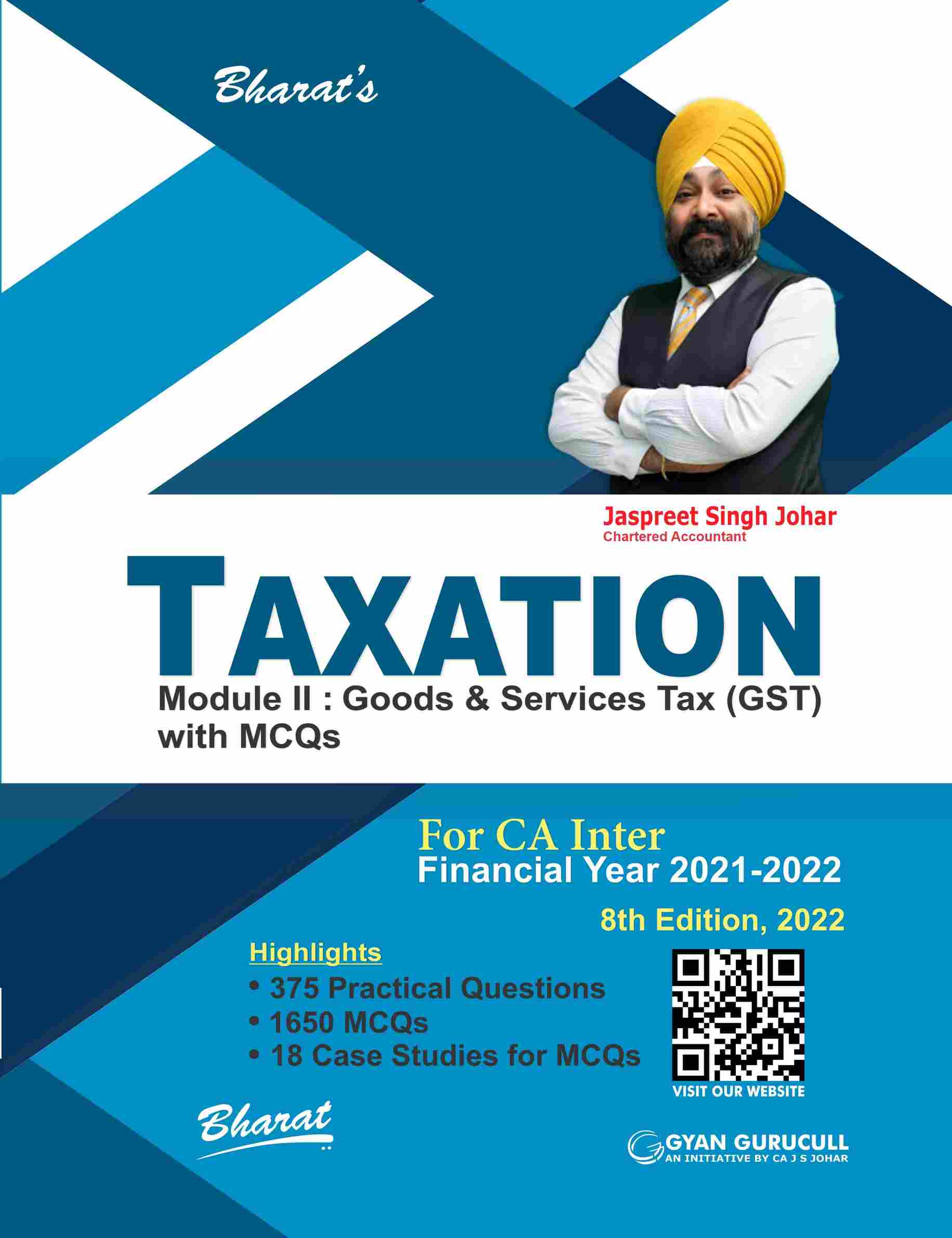

Chapter 1 Basic Introduction to Goods and Services Tax (GST)

MCQs

Chapter 2 Chargeability under CGST and IGST

MCQs

Chapter 3 Registration under GST (Section 22 to 30/Rule 8-26 of CGST Rules, 2017)

Annexure: State Codes for GSTIN

MCQs

Chapter 4 Supply under GST

Extra Questions

MCQs

Chapter 5 Exemptions under GST

Extra Questions

MCQs

Chapter 6 Value of Supply under GST

Extra Points

Extra Questions

MCQs

Chapter 7 Composition Scheme (Section 10/Rule 3-7 of CGST Rules, 2017)

Extra Questions

MCQs

Chapter 8 Input Tax Credit under GST (Sections 16, 17, 18)

MCQs

Chapter 9 Time of Supply Under GST

Extra Questions

MCQs

Chapter 10 Payment of GST (Sections 49, 50 and Rules 85, 86, 87, 88)

MCQs

Chapter 11 Invoice under GST (Section 31 to 34 of CGST Act, 2017 & Section 20 of IGST Act, 2017)

Extra Questions

MCQs

Details :

- Publisher : Bharat Law House Pvt. Ltd.

- Author : Jassprit S Johar

- Edition : 8th Edition 2022

- ISBN-13 : 9789390854196

- ISBN-10 : 9789390854196

- Pages : 404 pages

- Language : English

- Binding : Paperback

Reviews

There are no reviews yet.