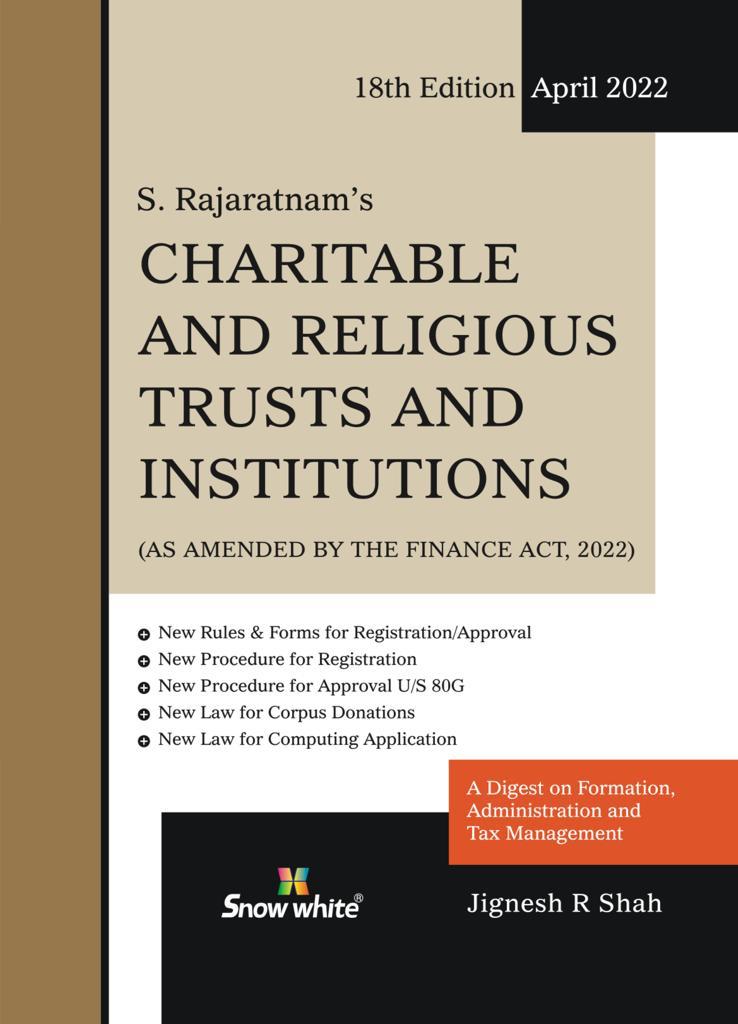

Description

CHAPTER 1

FORMATION OF CHARITY ‘- AVAILABLE OPTIONS

CHAPTER 2

FORMATION OF TRUST

CHAPTER 3

FORMATION OF A COMPANY

CHAPTER 4

SOCIETY _ REGISTRATION PROCEDURE

CHAPTER 5

CREATION OF PUBLIC RELIGIOUS CHARITABLE TRUST

CHAPTER 6

OBJECTS FOR CHARITIES

CHAPTER 7

RESPONSIBILITIES OF TRUSTEE/MANAGEMENT OF CHARlT1ES

CHAPTER 8

EDUCATIONAL/MEDlCAL TRUSTS

CHAPTER 9

ADMINISTRATION OF PUBLIC INSTITUTIONS

CHAPTER 10

CHARITY AND BUSINESS

CHAPTER 11

CHARITY AND CAPITAL GAINS

CHAPTER 12

SAFEGUARDS AGAINST FORFEITURE OF EXEMPTION

CHAPTER 13

INVESTMENTS

CHAPTER 14 ‘

REGISTRATION PROCEDURE

CHAPTER 15

APPLICATION OF INCOME – RULES

CHAPTER 16

ACCUMULATION OF INCOME – RULES

CHAPTER 17

PROCEDURAL OBLIGATIONS UNDER INCOME·TAX LAW

CHAPTER 18

CONCESSIONS FOR DONORS

CHAPTER 19

CHARITIES AND OTHER LAWS

CHAPTER 20

IMPORTANT PRECEDENTS ON THE SUBJECT OF CHARITIES

ANNEXURE

Details :

- Publisher : Snow White Publications Pvt. Ltd

- Author : S Rajaratnam

- Edition : 18th Edition April 2022

- ISBN-13 : 9789390740291

- ISBN-10 : 9789390740291

- Pages : 490 pages

- Language : English

- Binding : Paperback

Reviews

There are no reviews yet.