Description

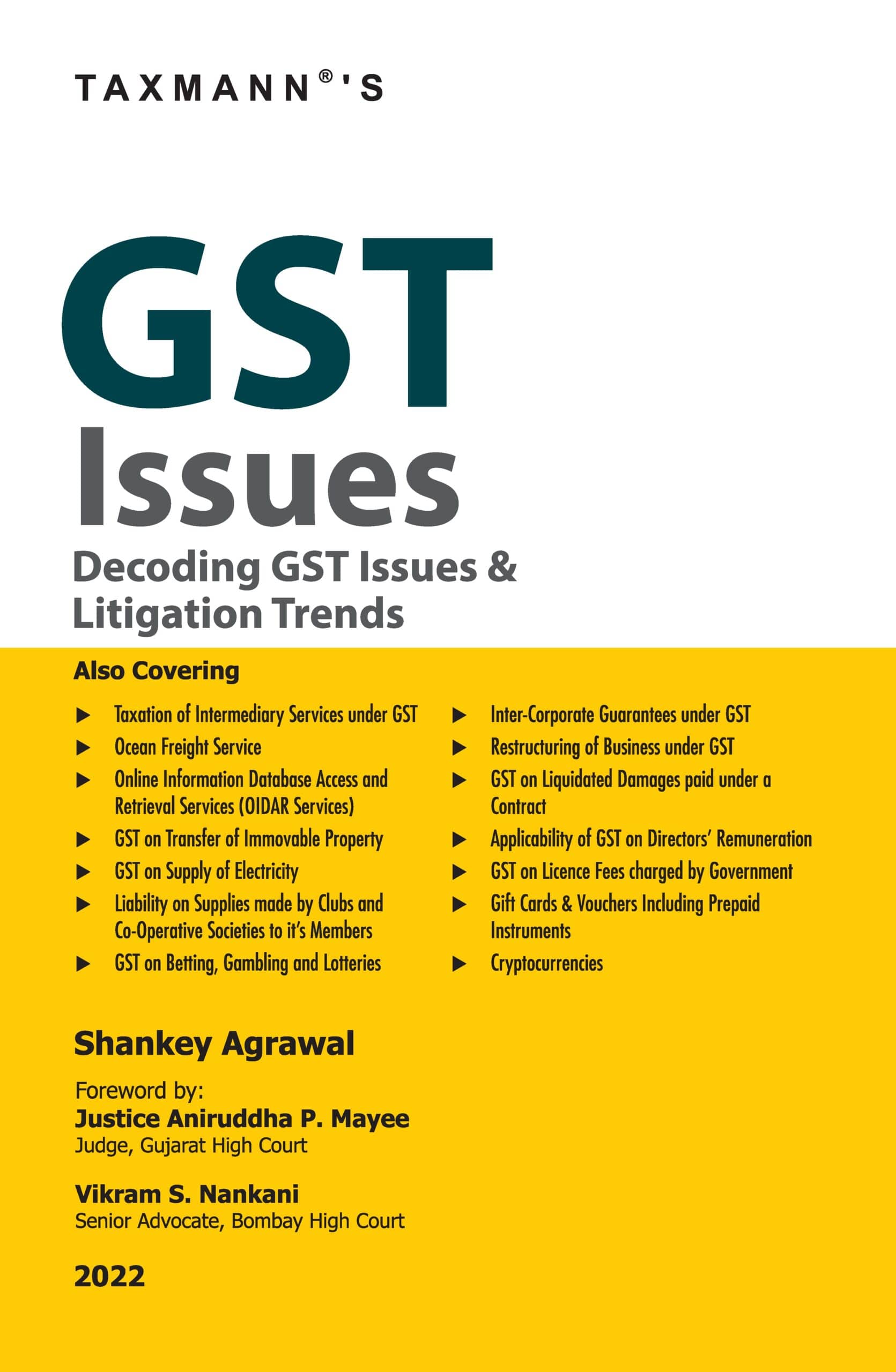

This book is an attempt to explore the following (broad) areas of GST Law that have been contentious between the Department and taxpayers:

- Constitutional background of GST & the related controversies

- Existing legal controversies

- Future legal controversies

- Enforcement of provisions of GST

- Investigations

- Criminal Offences

- Remedies

This book will prove to be a helpful guide for all GST Practitioners (including Chartered Accountants, Lawyers, etc.) Students & the officers of the Department etc.

The Present Publication is the latest 2022 Edition, updated till 31st March 2022, authored by Shankey Agrawal. The coverage of this book includes:

- [Background]

- Various stages of GST Litigation

- Authorities responsible for administering the GST Litigation

- Summarising major trends relating to GST litigation since its inception

- [Transactions] that have given rise to legal or constitutional issues

- Summarising relevant GST provisions for contentious transactions, including implications under the erstwhile taxation scheme

- The genesis of the controversy, along with leading judgements on such issues

- The present status of each controversy, along with corrective steps or legislative changes after the inception of the controversy

- [Basic Concepts] that every GST practitioner must be aware about:

- Discussed in detail with the help of relevant legal provisions, rules, departmental circulars, etc.

- Legal issues surrounding the concepts have been described in detail, along with the present status of such controversies

- [Enforcement & Recovery] mechanism under GST

- Anti-evasion provision under GST

- Enforcement and related legal challenges

- Remedies including bail against arrest proceedings

The detailed contents of the book are as follows:

- Brief overview of the Litigation Process under GST & Emerging Litigation Trends

- Taxation of Intermediary Services under GST

- Ocean Freight Service

- Online Information Database Access and Retrieval Services (OIDAR Services)

- GST on Transfer of Immovable Property

- GST on Supply of Electricity

- Liability on Supplies made by Clubs and Co-operative Societies to its Members

- GST on Betting, Gambling and Lotteries

- Inter-corporate Guarantees under GST

- Restructuring of Business under GST

- GST on Liquidated Damages paid under a Contract

- Applicability of GST on Directors’ Remuneration

- GST on Licence Fees charged by Government

- Gift Cards & Vouchers, including Pre-paid Instruments

- Cryptocurrencies

- Input Tax Credit-related provision under GST & related Challenges

- Valuation of Goods and Services under GST

- Composite and Mixed Supply in GST

- Import & Export of Goods under GST

- Import & Export of Services under GST

- Inverted Tax Structure under GST

- Anti-profiteering Mechanism

- Delegated Legislation: Validity of Sub-ordinate Rules and Notifications

- Retrospective amendments under GST Law and their validity

- Circulars & Instructions under GST

- GST Appellate Tribunal and its’ Constitutional Validity

- Eligibility to claim Pre-GST Credits and its transition to GST

- Power of States & Centre to amend the erstwhile laws after the introduction of GST

- Non-continuity of Area Based Exemptions under GST

- Power of Taxation by Municipalities and Local Bodies after the introduction of GST

- Concept of Proper Officer and its relevance under GST

- Powers of Search and Seizure under GST

- Provisional Attachment of Taxpayer’s Property

- E-way Bill and Detention of Goods and Vehicles during Transit

- Arrest Powers under GST

- Bail and other Legal Remedies for Judicial Intervention against Arrest

Details

- Binding : Paperback

- Publisher : Taxmann

- Author : Taxmann

- Edition : 1st Edition April 2022

- Language : English

- ISBN-10 : 9789356220720

- ISBN-13 : 9789356220720

Reviews

There are no reviews yet.