Description

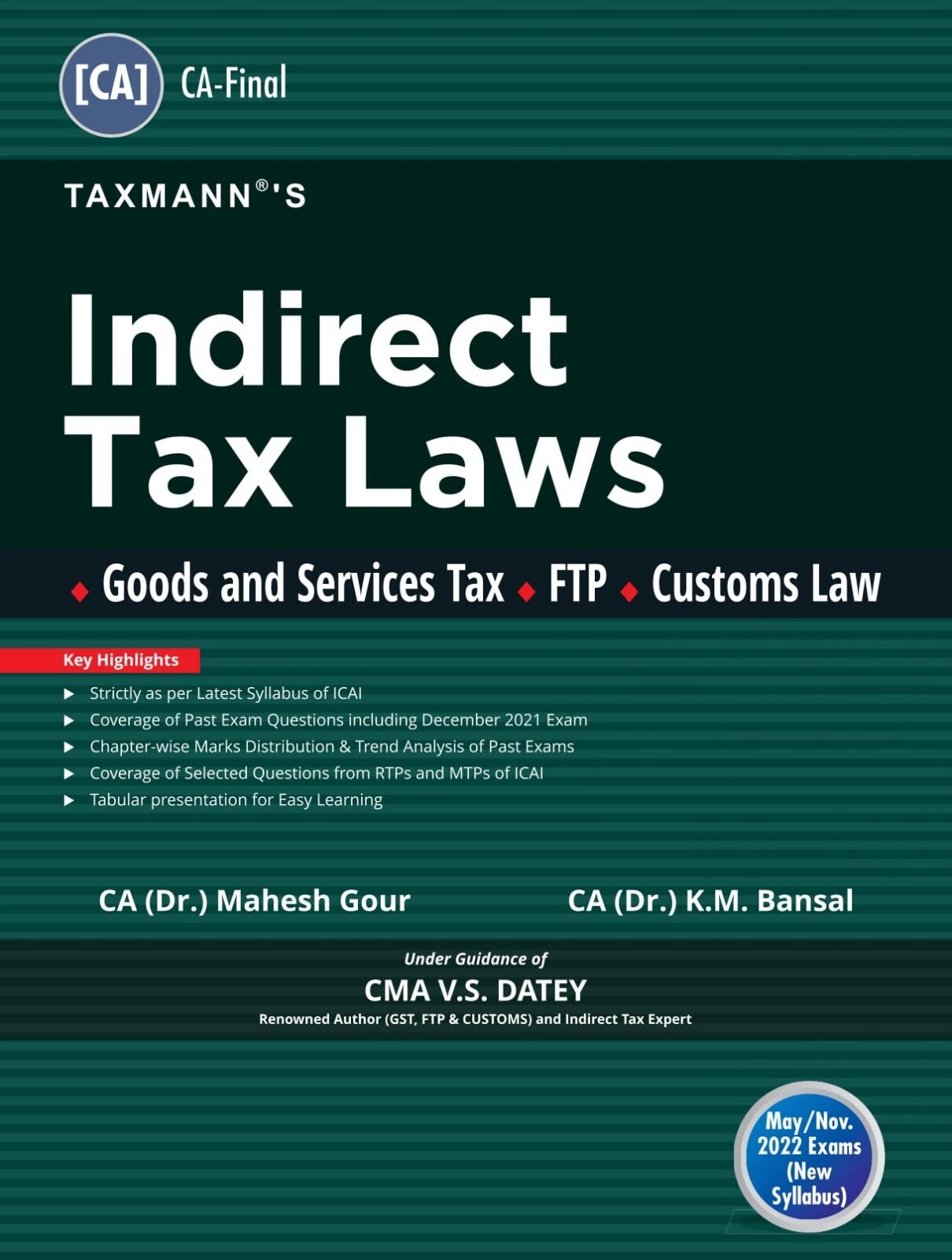

This book provides practical application of GST and Customs Tax in a holistic approach while testing the analytical skills of the reader. It is prepared exclusively for the Final Level of Chartered Accountancy Examination requirement. It covers the entire revised, new syllabus as per ICAI.

The Present Publication is the 1st Edition & Updated till 31st October 2021 for CA-Final | New/Old Syllabus | May/Nov. 2022 Exams. This book is authored by CA (Dr.) Mahesh Gour & CA (Dr.) K.M. Bansal under the guidance of CMA V.S. Datey. This book incorporates the following noteworthy features:

- Strictly as per the New Syllabus of ICAI

- This book is divided into two parts:

- Goods & Services Tax | 75 Marks

- Customs & Foreign Trade Policy (FTP) | 25 Marks

- Coverage of this book includes:

- All Past Exam Questions, including

- CA Final December 2021 (New Syllabus)

- Questions from RTPs and MTPs of ICAI

- All Past Exam Questions, including

- [Chapter-wise Marks Distribution] for Past Exams from May 2018 onward

- [Trend Analysis] for Past Exams

- [Tabular Presentation] for easy learning

- [Explanatory & Analytical Approach] to enable students to obtain knowledge in the subject with ease

- [Most Updated & Amended] This book is updated & amended up to 31st October 2021, and the amendments are incorporated at the relevant places

Also Available:

- [1st Edition] of Taxmann’s PROBLEMS & SOLUTIONS for Indirect Taxes Law & Practice

- [5th Edition] of Taxmann’s CRACKER for Indirect Taxes Law & Practice

- [4th Edition] of Taxmann’s CLASS NOTES for Indirect Tax Laws | IDT SAAR

- Taxmann’s Combo for TEXTBOOK + PROBLEMS & SOLUTIONS + CRACKER + CLASS NOTES

Contents of this book are as follows:

- Goods and Services Tax

- GST in India – An Introduction

- Supply under GST

- Charges of GST

- Exemptions of GST

- Place of Supply

- Time of Supply

- Value of Supply

- Input Tax Credit

- Registration

- Tax Invoice, Credit/Debit Notes

- Accounts and Records & E-Way Bill

- Payment of Tax

- Returns

- Import and Export under GST

- Refund under GST

- Job Work

- Assessment and Audit

- Inspection, Search, Seizure and Arrest

- Demands and Recovery

- Liability to Pay in Certain Cases

- Offences and Penalties

- Appeals and Revision

- Advance Ruling

- Miscellaneous Provisions

- Customs & Foreign Trade Policy

- Levy of Exemptions from Customs Duty

- Types of Duty

- Classification of Imported and Exported Goods

- Valuation under the Customs Act, 1962

- Importation, Exportation and Transportation of Goods

- Warehousing

- Duty Drawback

- Refund

- Foreign Trade Policy

Details :

- Publisher : Taxmann

- Author : Mahesh Gour, K.M. Bansal, V.S. Datey

- Edition : 1st Edition January 2022

- ISBN-13 : 9789392211515

- ISBN-10 : 9789392211515

- Language : English

- Binding : Paperback

Reviews

There are no reviews yet.