Description

This book aims to build up the students’ knowledge base & lay the foundation for their professional education. It endeavours to provide a good command of the basics such as Accounting Concepts & Conventions, Capital & Revenue Items, etc., to be well equipped to face the CA Intermediate level of Accounting.

This book is prepared exclusively for the Foundation Level of Chartered Accountancy Examination requirement. It covers the entire revised, new syllabus as per ICAI.

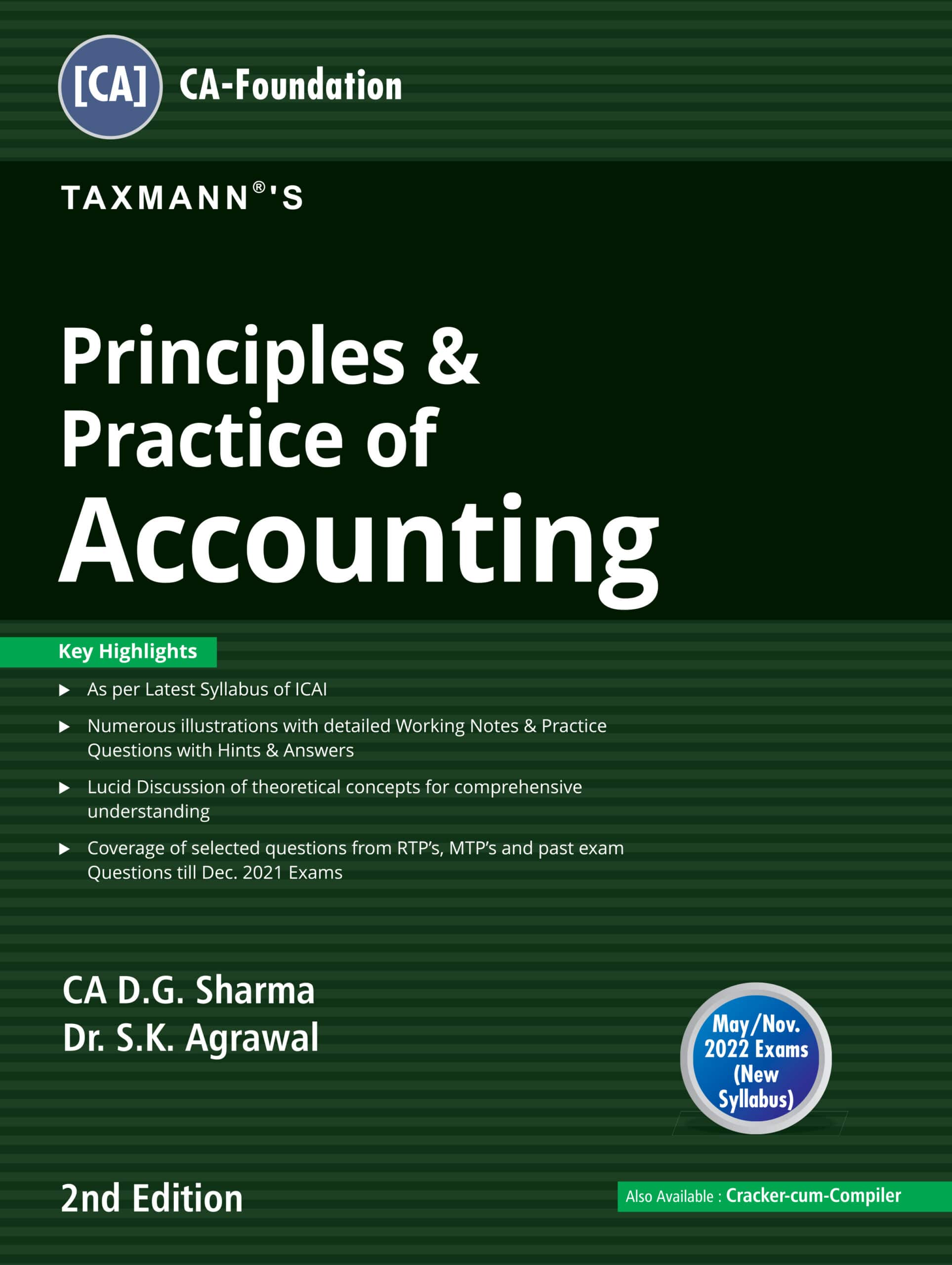

The Present Publication is the 2nd Edition for CA-Foundation | New Syllabus | May/Nov. 2022 exams, authored by CA D.G. Sharma & Dr S.K. Agrawal, with the following noteworthy features:

- [Numerous Illustrations] have been incorporated in the book

- [Detailed Working Notes & Practice Questions] along with Hints & Answers have provided in the book

- [Lucid Discussions in a Simple Language] for theoretical concepts is provided for a comprehensive understanding

- Coverage of this book includes:

- Questions from RTPs & MTPs of ICAI

- Past Exam Questions till Dec. 2021 Exam

Also Available:

- [CRACKER] for Taxmann’s Principles & Practice of Accounting

- Taxmann’s Combo for TEXTBOOK + CRACKER

Contents of this book are as follows:

- Theoretical Framework – Meaning & Scope of Accounting

- Theoretical Framework – Accounting Concepts, Principles & Conventions

- Theoretical Framework – Capital and Revenue Expenditure

- Theoretical Framework – Contingent Assets and Contingent Liabilities

- Theoretical Framework – Accounting Policies

- Theoretical Framework – Accounting Standards – Concepts, Objective, Benefits

- Theoretical Framework – Accounting as a Measurement Discipline – Valuation Principles, Accounting Estimates

- Accounting Process (Journal, Ledger, Trial Balance, Cash Book, Subsidiary Books)

- Bank Reconciliation Statement

- Bills of Exchange

- Rectification of Errors

- Depreciation

- Final Accounts

- Inventory Valuation

- Sale of Goods on Approval or Return Basis

- Consignment Accounts

- Average Due Date

- Account Current

- Not for Profit Organization

- Partnership

- Company Accounts – Shares

- Company Accounts – Debentures

- Company Accounts – Financial Statement of Companies

Details :

- Publisher : Taxmann

- Author : D.G. Sharma S.K. Agrawal

- Edition : 2nd Edition February 2022

- ISBN-13 : 9789393880987

- ISBN-10 : 9789393880987

- Language : English

- Binding : Paperback

Reviews

There are no reviews yet.