Description

-

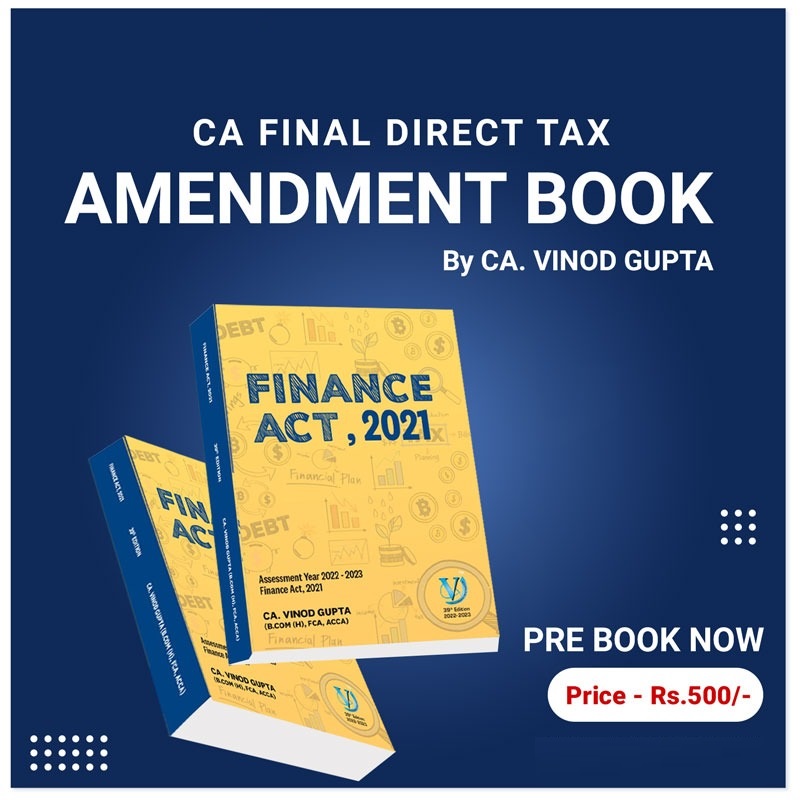

- Tax Rates for Assessment Year 2022-23

- Capital Gains

- Income from Other Sources

- Taxation of income from Dividend and Deemed Dividend

- Taxation of income on Units

- Profits and Gains of Business or Profession

- Deduction of tax at source

- New Pension Scheme

- Set Off or Carry Forward and Set-Off of Losses

- Taxation of Business trust and unit holders

- Taxation of Charitable / Religious Trusts

- Alternate Minimum Tax (AMT)

- Minimum alternate tax (MAT)

- Deduction under Chapter VI-A

- Filing?of Return of income&.?Assessment Procedure

- Time limits for completion of Assessment or Reassessment

- Special procedure of Assessment or Reassessment in case of search & seizure

- Appeals & Revision

- Statement of Financial Transaction

- Penalties & Prosecutions

- Place of Effective Management (POEM)

- Taxation of NRI

- Double taxation Avoidance Agreements

- Conversion of Indian Branch of A Foreign Bank Into A Subsidiary Company

- Business Connection

- Report in Respect of International Group (Section 286)

- Other Amendments By Finance Act 2021 & Some Important Case laws

About The Author

Vinod Gupta qualified CA with rank in C.A. Intermediate and C.A. Final examination in 1986. He has been awarded for the best paper on Taxation in C.A. Final Examination. He has authored around 150 articles on taxation in various journals and newspapers including Taxman, Current Tax Reporter, Chartered Accountant, Economic Times and Financial Express. He is currently teaching CA Final students in all over India a. He is having vast experience of teaching Direct tax, faculty at New Delhi for last 25 years.

He is the ultimate option for all CA students when it comes to take coaching of DT subject. He is one of the most respectable faculties all across India as well as in Nepal. He shares his 25 years of experience with the students in the class which is truly helpful for them and it also makes the teaching methodology unique and acceptable. He has been a guide to all his students and treats them as gems. There is thousands of CA who have taken coaching from including several rank holders

| bookauthor | Vinod Gupta |

|---|---|

| binding | Paperback |

| edition | 2022 |

| hsn | 49011010 |

| isbn | 9773213000013 |

| language | English |

| publisher | VG Learning Destination |

| Number of Pages | 209 |

Reviews

There are no reviews yet.