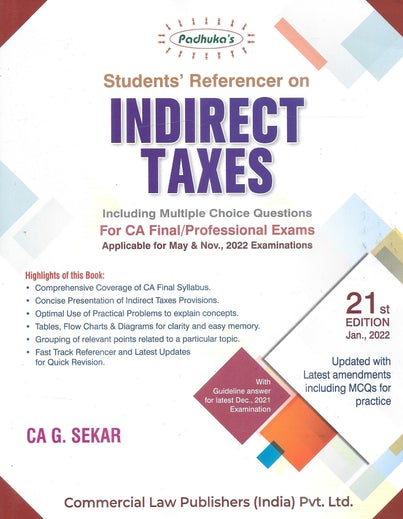

Description

Highlights of the Book:

- Comprehensive Coverage of all the Topics in the CA Final Syllabus – Indirect Taxes Subject

- Included Multiple Choice Questions [MCQ’s] for Practice

- Complete Coverage of GST Law & Customs Act in student friendly man.ner

- Use of Tables, Flow Charts and Diagrams for clarity and easy memory

- All points relevant to a topic discussed in one place (Act, Rules, Case Law, etc.).

- Complete Coverage of all Latest Case Laws, Circulars and Notifications including Select AAR decisions for knowledge update.

- Solved Answers up to Recent CA Final Exams included in respective Chapters

- Salient Aspects of Foreign Trade Policy have been dealt in separate Chapter.

- Fast Track Referencer given separately for easy revision.

About Author:

G. Sekar :G. Sekar is a Chartered Accountant in practice for the last 33 years.

Founder and Faculty of Direct Taxation in Shree Guru Kripa’s Institute of Management, an Institution providing education for all levels and all subjects of the Chartered Accountancy Courses and has trained many finance professionals.

Member – Central Council of ICAI – 2013-16, 2016-19 & 2019-22.

Chairman – Direct Taxes Committee of ICAI – 2014.

Chairman – Auditing And Assurance Standards Board of ICAI – 2019 & 2020.

Great Motivator for Chartered Accountants in Practice and in Employment, and CA Students, through his effective and convincingcommunication style.

1. Commerce Graduate, Gold Medalist & Rank Holder from Madurai Kamaraj University.

2. Member of Expert Study Group Committee, CBDT, New Delhi, to study the Direct Tax Code Bill in 2006.

3. Recipient of Special Award from the Income Tax Department in 2011, during their “150 years of Income Tax in India” Celebrations, for his contribution and service to the Income Tax Department.

4. Speaker on Budget, Direct and Indirect Taxation in Doordarshan & other Television Channels & Print Media Programmes.

5. Board Member, Airports Authority of India (2019-22).

6. Member of Consultative Advisory Group (CAG) of IFAC-2017-19, International Accounting Education Standards Board (IAESB).It is worthy to note that he is the First Indian to be part of the CAG.

7. Faculty Member of The Institute of Chartered Accountants of India and its Branches, and other Professional and Management Institutions,for CA Intermediate/IPCC and CA Final Level, for the subjects Income Tax, Service Tax, VAT, Direct Tax Law, etc.

8. Author of Professional Books – for Finance and Legal Professionals, Corporate Taxpayers, Banks, Officials of Income Tax Department, etc.

(a) Handbook on Direct Taxes – (Recommended for IRS Trainees at NADT)

(b) Professional Manual on Accounting Standards

(c) Practical Guide on TDS and TCS – (Approved Book for ITOs)

(d) Professional Guide to Tax Audit

(e) Personal Income Tax – A Simplified Approach

(f) Professional Guide to CARO 2016

(g) A Professional Guide to Income Computation & Disclosure Standards (ICDS)

(h) Handbook for The Insolvency and Bankruptcy Code, 2016

(i) Author of Special Series GST Books for Professionals – GST Manual, GST Self Learning, GST Ready Reckoner.

9. Author of Books for CA Students – Authored about 27 Books covering the entire curriculum of CA Course. Shree Guru Kripa’s Institute of Management is the First and Only Educational Institution in India to accomplish this feat.

Details :

- Publisher : Commercial Law Publishers (India) Pvt. Ltd.

- Author : G. Sekar

- Edition : 21st Edition January 2022

- ISBN-13 : 9789392141904

- ISBN-10 : 9789392141904

- Binding : Paperback

- Language : English

Reviews

There are no reviews yet.